charitable gift annuity minimum age

12 rows When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000. Charitable Gift Annuities are growing in popularity in todays low interest economy as a way to increase guaranteed lifetime income and benefit the church.

Charitable Gift Annuities Barnabas Foundation

Doctors Without BordersMédecins Sans Frontières MSF will accept current gift annuities which begin.

. Explore annuity options on our charitable gift annuities information page. Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. The minimum gift amount is 25000 and the minimum age is 65 years at the commencement of income payments for deferred gift annuities.

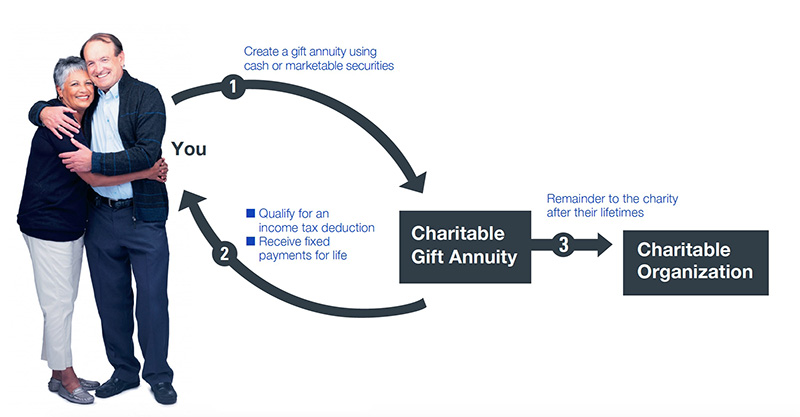

If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an. The amount of the annuity payment depends on the age of the individual receiving the income or the combined age of two. Ad Build your Career in Data Science Web Development Marketing More.

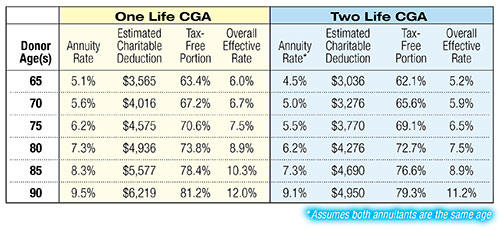

Is a Humane Society gift annuity the right choice for you. For example a married couple ages 65 and one 66 make a 100000 cash contribution to a charity in return for a charitable gift annuity. The older you are when you make your gift the greater the payment rate you will receive.

If you choose other people to receive the payments from your gift annuity their ages at the time of. The minimum gift annuity to SUNY Cobleskill Foundation is 10000 and minimum ages is 60 for immediate annuities but 40 for deferred annuities. The minimum age to fund an immediate gift annuity is 55.

Ad Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. Give And Gain With CMC. Invest 2-3 Hours A Week Advance Your Career.

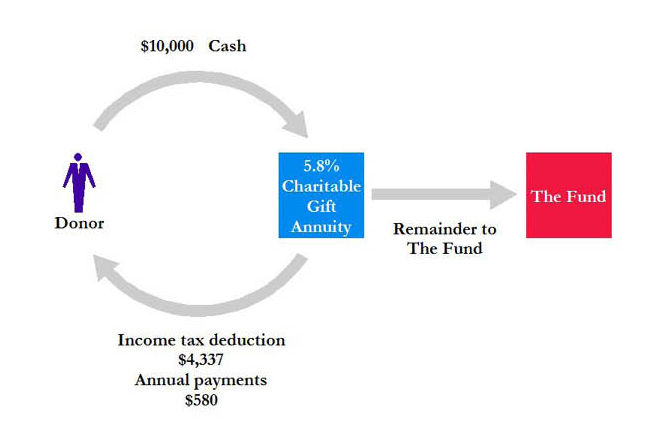

Rates begin at 33 for single-life. Lifetime payments are to begin. The minimum required gift for a charitable gift annuity is 10000.

Is a Humane Society gift annuity the right choice for you. Earn Lifetime Income Tax Savings. Income rates are based on your age or the age of your beneficiary at the time payments commence.

Most gift annuity donors are. The minimum age at which an annuitant can receive payments is 65. Age Older Age Rate Younger Age Older Age Rate Younger.

Determine how much you will give. Earn Lifetime Income Tax Savings. Opportunity Ȫ An alumnus age 55 has.

The annuity rate is based on the age and number of annuitants. The most recently published rates apply to gift annuities issued on or after July 1 2008. Current gift annuity rates are 49 for donors age 60 6 for donors age 70 and.

Give And Gain With CMC. 125 rows Multiply the compound interest factor F by the immediate gift annuity rate for the nearest age or ages of a person or persons at the annuity starting date. Charities must use the gift.

For illustrative purposes a 60-year-old who donates 10000 may receive a rate of 44 paying 440 annually while an 85-year-old will see a rate of 78 paying 780 annually for the same. Ad Support our mission while your HSUS charitable gift annuity earns you income. To receive a steady stream of income in return for your gift while enjoying the benefit of a substantial charitable.

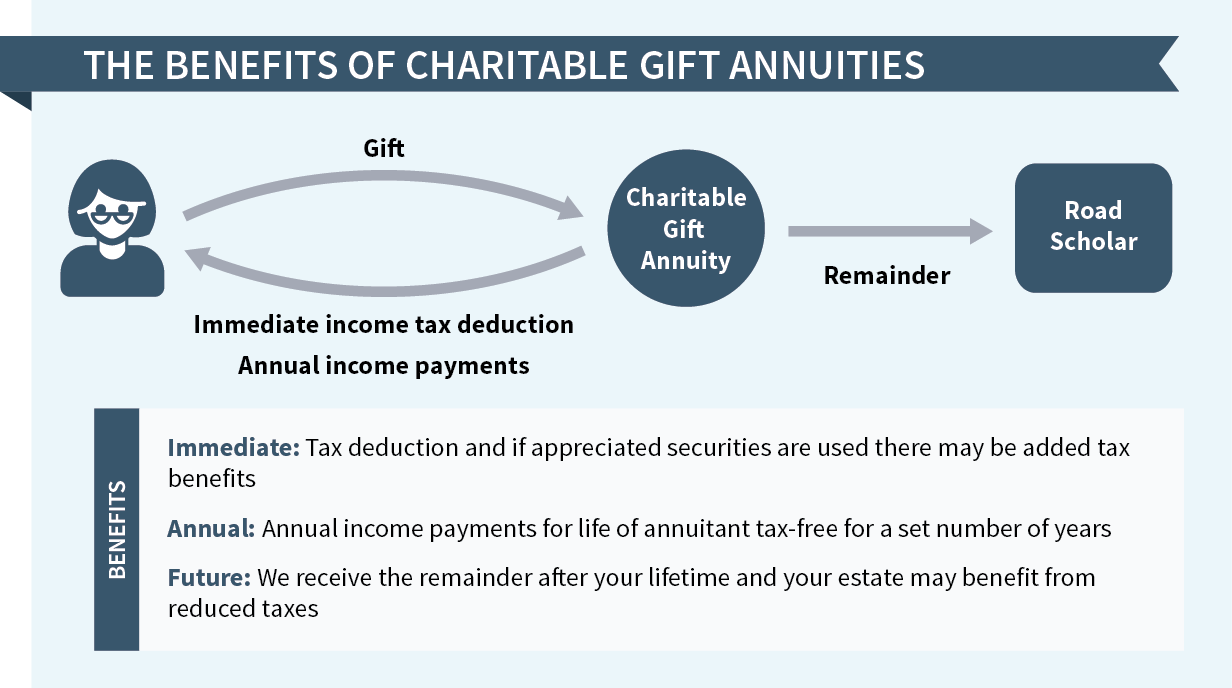

A charitable deduction is available for a portion of your contribution on your income. A portion of the payment is tax-free. Ad Support our mission while your HSUS charitable gift annuity earns you income.

SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021. Flexible Online Learning at Your Own Pace. Ad Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments.

Charitable Gift Annuities Giving To Stanford

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

Charitable Gift Annuity Immediate University Of Virginia School Of Law

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

Charitable Gift Annuities Studentreach

Rising Rates On Charitable Gift Annuities The Institute For Creation Research

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity How It Benefits Others And You

Annuities The Catholic Foundation

Charitable Gift Annuities Mission To The World

Acga Charitable Gift Annuity Rates

City Of Hope Planned Giving Fall Annuity

Charitable Gift Annuities Guillaume Freckman Inc

Charitable Gift Annuities The Field Museum

Charitable Gift Annuity Rate Increases Texas A M Foundation

What Is A Charitable Gift Annuity Actors Fund

Charitable Gift Annuities Wellesley College